Bad Google Reviews and Defamation: Protecting Your Business Reputation

In today’s digital age, online reviews play a crucial role in shaping a business’s reputation. Positive reviews can boost credibility…

Differentiating between anti-competitive clauses under Section 45 (1.1) of the Competition Act and non-solicit clauses

In June 2022, the Government of Canada made changes to the Competition Act. One of these changes added subsection 45(1.1)…

Decoding The Legal Jargon: A Comprehensive Guide to Understanding Your Employment in Canada (Part 2)

Decoding The Legal Jargon: A Comprehensive Guide to Understanding Your Employment in Canada (Part 2) Key Components of Your Employment…

Are you using AI to conduct legal research: The Courts have ChatGOTCHA!

Are you using AI to conduct legal research: The Courts have ChatGOTCHA! Key takeaways from Zhang v. Chen 2024 BCSC…

Decoding The Legal Jargon: A Comprehensive Guide to Understanding Your Employment in Canada (Part 1)

Decoding The Legal Jargon: A Comprehensive Guide to Understanding Your Employment in Canada (Part 1) Introduction: Employment agreements form the…

Termination Letter in Alberta Review

You Received a Termination of Employment Letter in Alberta. Now What? The Necessity of Having Your Termination Letter Reviewed by…

Maternity leave in Alberta

Maternity, Paternity, and Parental Leave in Alberta: Understanding the Policies and Implications Alberta, has established specific policies regarding maternity, paternity,…

Human Rights Lawyers Calgary

Human Rights Lawyers in Calgary Understanding Your Human Rights: Osuji & Smith Lawyers, Calgary In an era where awareness and…

Personal Injury: Collision with Emergency Vehicles in Alberta

Personal Injury: Collision with Emergency Vehicles in Alberta Have you ever been involved in an accident involving an emergency vehicle…

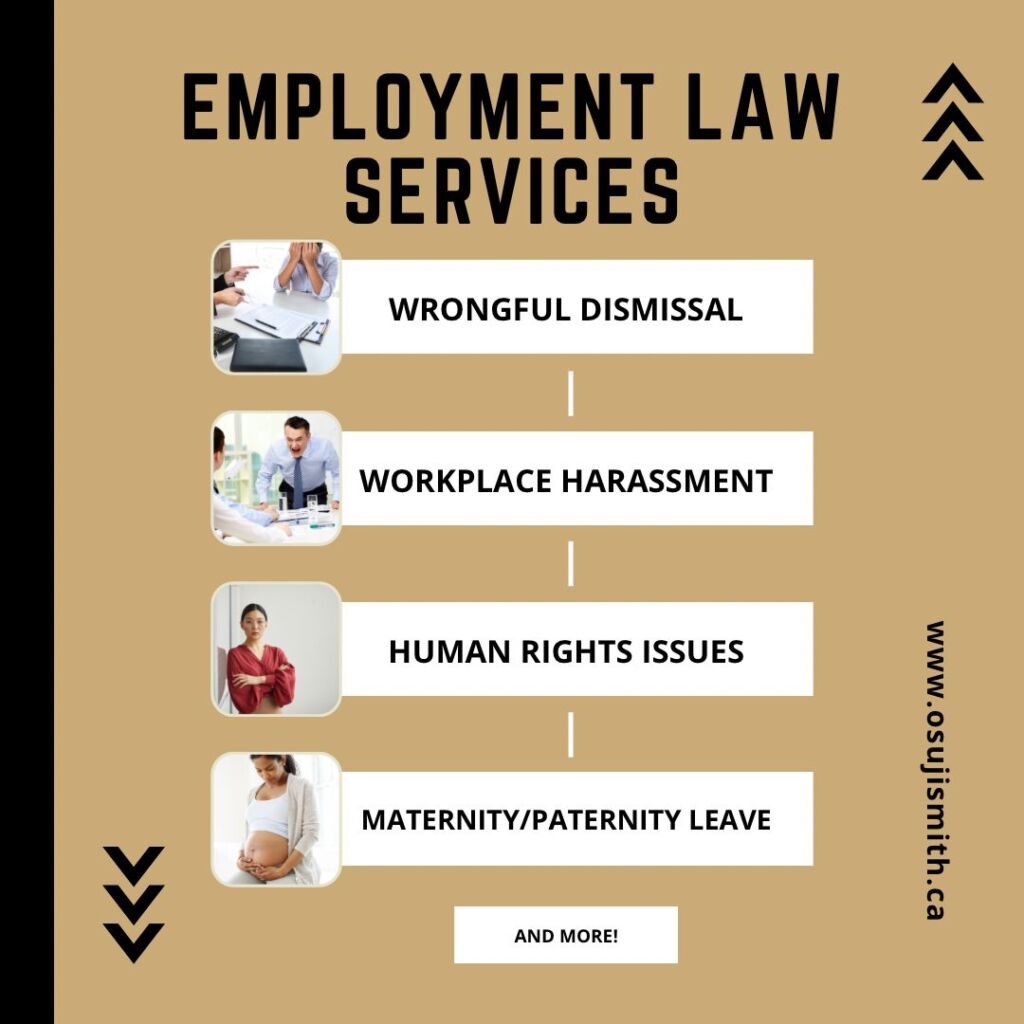

Alberta Employment Lawyers

Alberta Employment Lawyers – Osuji & Smith Lawyers Osuji & Smith Alberta Employment Lawyers stand out as a beacon of…

Falling in Love: Maria’s Story

Love is strange. It is said to make fools out of even the most brilliant. In the beginning, it was…

The Complexities of Fixtures in Home Properties and Their Impact on Property Transactions in Alberta

The Complexities of Fixtures in Home Properties and Their Impact on Property Transactions in Alberta In the realm of property…

Am I being constructively dismissed? Constructive Dismissal in Alberta

Am I being constructively dismissed? CONSTRUCTIVE DISMISSAL IN ALBERTA The term “constructive dismissal” can be confusing for many employees. Let’s…

GROUNDBREAKING Acquisition of Fisher Law By Osuji and Smith Lawyers

Osuji & Smith Announces Acquisition of Fisher Law, Championing an Ecosystem of Support for Immigrants in Canada Calgary, Alberta,…

Severance Package Reviews | Calgary Employment Lawyers

SEVERANCE PACKAGE REVIEWS | CALGARY EMPLOYMENT LAWYERS The Importance of Legal Review for Your SEVERANCE PACKAGE IN ALBERTA: What You…

Will sexual harassment always lead to dismissal for cause in Alberta?

Will SEXUAL HARASSMENT always lead to dismissal for cause in Alberta? For employers, allegation of sexual harassment by one employee…

Severance Package Reviews in Calgary, Alberta

SEVERANCE PACKAGE REVIEWS in Calgary, Alberta In the evolving landscape of employment and labor law, severance packages have become a…

Unfulfilled Aspirations: Riya’s Story

It was difficult to leave home and step out into a distant land. I did, nonetheless. After getting my permanent…

Alberta Employment Standards Rules

Alberta Employment Standards Rules The Alberta Employment Standards Rules provide the minimum standards that employers in Alberta must meet. These…

Workplace Investigations in Alberta – When and How to Conduct Them

WORKPLACE INVESTIGATIONS IN ALBERTA – When and How to Conduct Them Employers in Alberta are not legally required to conduct…

MY JOURNEY with Calgary Lawyer CHARLES OSUJI

MY JOURNEY with CALGARY LAWYER CHARLES OSUJI Charles Osuji is a multi-award-winning lawyer and the CEO of Calgary’s Osuji &…

Osuji & Smith Calgary Lawyers, 2024 ThreeBestRatedⓇ Award Winner From Calgary Shares Their Year In Review!

Osuji & Smith Calgary Lawyers, 2024 ThreeBestRatedⓇ Award Winner From Calgary Shares Their Year In Review! Osuji & Smith Lawyers…

An Academic Odyssey in Canada: Kamal’s Story

Encountering the vibrant streets of Bangalore and the tranquil landscapes of Calgary has been an incredibly transforming experience for me…

Can one parent decide to move without the agreement of the other parent in Alberta?

Can one parent decide to move without the agreement of the other parent in Alberta? In Alberta, Canada, the decision…

How does Family property division affect spousal / partner support entitlement in Alberta?

How does Family property division affect spousal / partner support entitlement in Alberta? In Alberta, the division of family property…

What items can be divided as part of Family property in Alberta?

What items can be divided as part of Family property in Alberta? In Alberta, Canada, the division of family property…

How can you safeguard property and your interest in those properties after separation in Alberta?

How can you safeguard property and your interest in those properties after separation in Alberta? Safeguarding property and personal interests…

What does “Equalization” mean in Family property division in Alberta?

What does “Equalization” mean in Family property division in Alberta? Equalization in the context of family property division in Alberta…

How is each party’s share of Family property calculated in Alberta?

How is each party’s share of Family property calculated in Alberta? In Alberta, the division of family property in the…

What items form part of Family property in Alberta?

What items form part of Family property in Alberta? In Calgary, Alberta, Canada, family property is governed by the Family…

What is the timeline to address property and division after you separate in Alberta?

What is the timeline to address property and division after you separate in Alberta? In Alberta, addressing property division after…

Reprisal and Employment Termination in Alberta

Reprisal and Employment Termination in Alberta Employees in Alberta have an inherent right to speak up against or report workplace…

Is property part of a Divorce judgment in Alberta?

Is property part of a Divorce judgment in Alberta? Divorce proceedings in Alberta, as in many jurisdictions, involve the division…

What incomes are used in calculating spousal or partner support in Alberta?

What incomes are used in calculating spousal or partner support in Alberta? In Alberta, the calculation of spousal or partner…

What determines the amount and length of support payment in Alberta?

What determines the amount and length of support payment in Alberta? Determining the amount and length of support payments in…

What reason can someone use for seeking spousal support or partner support in Alberta?

What reason can someone use for seeking spousal support or partner support in Alberta? In Alberta, the reasons for seeking…

What is partner support for a party determined in Alberta? Referring to unmarried couple

What is partner support for a party determined in Alberta? Referring to unmarried couple In Calgary, Alberta, Canada, the concept…

Is spousal or partner support an automatic right in Alberta?

Is spousal or partner support an automatic right in Alberta? Spousal or partner support, often referred to as alimony, is…

Can one parent decide to travel with the child without informing the other parent in Alberta?

Can one parent decide to travel with the child without informing the other parent in Alberta? When discussing whether one…

From Newcomer to CEO: The Power of Opportunity | Calgary Lawyer Charles Osuji | Ida Azefor Podcast

From Newcomer to CEO: The Power of Opportunity | Calgary Lawyer Charles Osuji | Ida Azefor Podcast From…

What factors are considered when determining if shared decision-making is appropriate in Alberta?

What factors are considered when determining if shared decision-making is appropriate in Alberta? When it comes to parenting and family…

What is shared or joint decision-making responsibility structure in Alberta? What does it mean?

What is shared or joint decision-making responsibility structure in Alberta? What does it mean? Shared or joint decision-making responsibility in…

Is it important to have a written parenting and decision-making agreement or court order immediately following separation in Alberta?

Is it important to have a written parenting and decision-making agreement or court order immediately following separation in Alberta? Writing…

Can a parent deny the other parent access and contact with their child in Alberta?

Can a parent deny the other parent access and contact with their child in Alberta? In Alberta, as in many…

Can a child’s input be considered when determining which parent becomes the primary caregiver in Alberta?

Can a child’s input be considered when determining which parent becomes the primary caregiver in Alberta? In Alberta, as in…

What circumstances and elements are looked at when determining which parent becomes the primary caregiver of a child in Alberta?

What circumstances and elements are looked at when determining which parent becomes the primary caregiver of a child in Alberta?…

What is a shared parenting arrangement in Alberta? What does it imply or mean?

What is a shared parenting arrangement in Alberta? What does it imply or mean? A shared parenting arrangement in Alberta…

Who can be asked to pay child support in Alberta?

Who can be asked to pay child support in Alberta? In Alberta, Canada, child support is a legal obligation that…

PROCESSING OF EMPLOYEE PERSONAL DATA UNDER THE ALBERTA PERSONAL INFORMATION PROTECTION ACT

PROCESSING OF EMPLOYEE PERSONAL DATA UNDER THE ALBERTA PERSONAL INFORMATION PROTECTION ACT: THE REASONABLE TEST OVERVIEW OF THE PERSONAL INFORMATION…

Understanding the Spectrum of Sexual Harassment in the Workplace in Alberta

Understanding the Spectrum of SEXUAL HARASSMENT IN THE WORKPLACE IN ALBERTA INSIGHTS FROM CAFÉ LA FORET LTD. V. CHO (2023…

Navigating Mental Health Accommodations in the Workplace in Alberta

Navigating MENTAL HEALTH ACCOMMODATIONS IN THE WORKPLACE IN ALBERTA Lessons from VOLPI V ALBERTA (HUMAN RIGHTS COMMISSION) 2023 ABKB In…

How to Avoid Legal Pitfalls as a Small Business Owner in Alberta

How to Avoid Legal Pitfalls as a SMALL BUSINESS OWNER IN ALBERTA When you are running a small business in…

Your Accident Lawyers in Calgary

Osuji & Smith: Your ACCIDENT LAWYERS IN CALGARY Accidents in Calgary Alberta are a distressing reality of life that can…

Your Calgary Employment Lawyers: Osuji & Smith

YOUR CALGARY EMPLOYMENT LAWYERS: Osuji & Smith The legal framework governing employment relationships in Calgary Alberta is both complex and…

Your Calgary Real Estate Lawyers

Your ONE STOP REAL ESTATE LAWYERS IN CALGARY, Osuji & Smith: Legal Excellence in Property Transactions Osuji & Smith: YOUR…

Osuji & Smith Lawyers, your Calgary Lawyers in Alberta

Osuji & Smith Lawyers, your CALGARY LAWYERS in Alberta Osuji & Smith: YOUR COMPREHENSIVE LEGAL PARTNERS IN CALGARY, ALBERTA In…

Osuji & Smith Lawyers, your Family and Divorce Lawyers in Alberta

Osuji & Smith Lawyers, YOUR FAMILY AND DIVORCE LAWYERS IN ALBERTA Navigating the complexities of family law in Alberta can…

Transition from Remote to Onsite Work in Alberta

Can employers force employees to move onsite from an earlier remote working arrangement in Alberta? CALGARY EMPLOYMENT LAWYERS, Osuji &…

Employees terminated for cause on grounds of misconduct can still claim EI successfully in Alberta

EMPLOYEES TERMINATED FOR CAUSE on grounds of misconduct can still claim EI successfully in Alberta. Osuji & Smith, CALGARY EMPLOYMENT…

Are employees in Alberta entitled to be paid for work done after hours?

Are employees in Alberta entitled to be paid for work done after hours? CALGARY EMPLOYMENT LAWYERS, Osuji & Smith Lawyers Explain…

Assessing employee liability at holiday parties hosted by their employer in Alberta

Assessing employee liability at holiday parties hosted by their employer in Alberta. ALBERTA EMPLOYMENT LAWYERS, Osuji & Smith Lawyers Explain…

The dangerous impact of your silence when your employment duties change at work in Alberta

The dangerous impact of your silence when your employment duties change at work in Alberta. ALBERTA EMPLOYMENT LAWYERS, Osuji &…

How to Break Free from those ‘Non-Competition’ and ‘Non-Disclosure’ Clauses in Alberta?

How to Break Free from those ‘NON-COMPETITION’ AND ‘NON-DISCLOSURE’ CLAUSES IN ALBERTA? Alberta Employment Lawyers, Osuji & Smith Lawyers Explain…

The impact of signing severance packages ‘just like that’ in Alberta

The impact of signing severance packages ‘just like that’ in Alberta The Consequences of Hastily Signing Severance Packages in Alberta,…

What exactly is ‘progressive discipline’ in the eyes of the Alberta courts to justify dismissal ‘for cause’?

What exactly is ‘progressive discipline’ in the eyes of the Alberta courts to justify DISMISSAL ‘FOR CAUSE’? Understanding ‘Progressive Discipline’:…

The Alberta courts are very interested in the manner of your dismissal much more than the cause, and here’s why

The Alberta courts are very interested in the ‘manner of your dismissal’ much more than the cause, and here’s why…

Are employers in Alberta at liberty to change your termination ‘without cause’ to ‘just cause”, and even claim on it?

Are employers in Alberta at liberty to change your TERMINATION WITHOUT CAUSE to JUST CAUSE, and even claim on it?…

Challenging Termination Provisions in Employment Contracts in Alberta

Challenging Termination Provisions in EMPLOYMENT CONTRACTS IN ALBERTA – Insights from Osuji & Smith EMPLOYMENT LAWYERS The realm of employment…

Success Looks Different Here: Ana’s Story

I moved here from Columbia when I was three years old. I don’t have many memories of my life there,…

The Right to Disconnect from Work in Alberta

THE RIGHT TO DISCONNECT FROM WORK IN ALBERTA A while ago, I was in Court, and I witnessed a fellow…

I have been put on a Performance Improvement Plan (PIP) – What now?

I have been put on a Performance Improvement Plan (PIP) – What now? When an employer puts an employee on…

The Importance of Real Property Report in Alberta and Necessity of Using Osuji & Smith Real Estate Lawyers

The Importance of Real Property Report in Alberta and Necessity of Using Osuji & Smith Real Estate Lawyers Real Property…

Real Estate Market Projection for Alberta: 2023 into 2024, Osuji & Smith Real Estate Lawyers Explain

Real Estate Market Projection for Alberta: 2023 into 2024, Osuji & Smith Real Estate Lawyers Explain The real estate market…

Liens on Title in Alberta: A Comprehensive Overview

Liens on Title in Alberta: A Comprehensive Overview In Alberta, like many jurisdictions, liens on the title are legal claims…

Does a company policy manual have a binding effect?

Does a company policy manual have a binding effect? In the realm of employment law, company policies play a crucial…

Rental Properties in Calgary, Alberta: A Distinctive Landscape Explained by Osuji & Smith Real Estate Lawyers

Rental Properties in Calgary, Alberta: A Distinctive Landscape Explained by Osuji & Smith Real Estate Lawyers Calgary, the largest city…

Newcomers to Canada and Property Acquisition in Alberta: Insights from Osuji & Smith Real Estate Lawyers

Newcomers to Canada and Property Acquisition in Alberta: Insights from Osuji & Smith Real Estate Lawyers Canada, with its stable…

Condo Purchases: A Comprehensive Guide with Insights from Osuji & Smith Lawyers – Focusing on Calgary, Alberta

Condo Purchases: A Comprehensive Guide with Insights from Osuji & Smith Lawyers – Focusing on Calgary, Alberta Condo purchases are…

How Osuji & Smith Calgary Real Estate Lawyers Can Elevate Your Property Transaction Experience

How Osuji & Smith Calgary Real Estate Lawyers Can Elevate Your Property Transaction Experience In the labyrinth of real estate…

Remedies for Closing Issues in Real Estate Transactions in Alberta: The Indispensable Role of Osuji & Smith Real Estate Lawyers

Remedies for Closing Issues in Real Estate Transactions in Alberta: The Indispensable Role of Osuji & Smith Real Estate Lawyers…

Closing Costs in Real Estate Transactions in Calgary, Alberta: The Importance of Legal Counsel from Osuji & Smith Lawyers

Closing Costs in Real Estate Transactions in Calgary, Alberta: The Importance of Legal Counsel from Osuji & Smith Lawyers The…

When is Title Insurance Necessary in Closing in Alberta? Osuji & Smith Real Estate Lawyers Explain

When is Title Insurance Necessary in Closing in Alberta? Osuji & Smith Real Estate Lawyers Explain When buying or selling…

First-Time Home Buyers in Calgary, Alberta: Navigating the Landscape with Osuji & Smith Lawyers

First-Time Home Buyers in Calgary, Alberta: Navigating the Landscape with Osuji & Smith Lawyers Buying your first home is a…

Moving Mountains of Paperwork: Rabia’s Story

I first visited snowy Canada in 2016 to see my mother and siblings. I am originally from Pakistan, but I…

Snowmobile Accidents and the Need for Personal Injury Lawyers: The Role of Osuji & Smith Lawyers

Snowmobile Accidents and the Need for Personal Injury Lawyers: The Role of Osuji & Smith Lawyers With winter’s arrival, snowmobile…

A Safe Place: Ambika’ Story

I moved to Canada from India for the first time in 2006. Before that, my husband and I were living…

Slip and Fall Accidents in Alberta: The Need for Contacting Personal Injury Lawyers in Calgary, Osuji & Smith Lawyers

Slip and Fall Accidents in Alberta: The Need for Contacting Personal Injury Lawyers in Calgary, Osuji & Smith Lawyers Slip…

Premises Liability and the Necessity of Engaging Personal Injury Lawyers at Osuji & Smith Lawyers in Calgary

Premises Liability and the Necessity of Engaging Personal Injury Lawyers at Osuji & Smith Lawyers in Calgary One of the…

Pedestrian Accidents: The Unseen Consequences and the Importance of Legal Representation from Osuji & Smith Personal Injury Lawyers in Calgary

Pedestrian Accidents: The Unseen Consequences and the Importance of Legal Representation from Osuji & Smith Personal Injury Lawyers in Calgary…

Dog Bites Accidents: Understanding the Implications and the Need for Osuji & Smith Lawyers in Calgary

Dog Bites Accidents: Understanding the Implications and the Need for Osuji & Smith Lawyers in Calgary Dog bites are a…

Stranded in Canada: Mei’s Story

I left China for Canada just before the start of the COVID pandemic in 2020, intending to visit my husband…

Defective Products and the Role of Hiring Osuji & Smith Personal Injury Lawyers

Defective Products and the Role of Hiring Osuji & Smith Personal Injury Lawyers Every year, a vast number of consumers…

Crossing Divides: Gabriel’s Story

I moved to Canada in the 1970s at 9 years old with my father, mother, and sisters. We fled Chile…

Essential Considerations for New Home Buyers in Calgary, Alberta

Essential Considerations for New Home Buyers in Calgary, Alberta: The Importance of Engaging Osuji & Smith Calgary Real Estate Lawyers…

The Critical Role of Birth Accident Lawyers: Why Firms like Osuji & Smith Lawyers Are Essential in Personal Injury Cases

The Critical Role of Birth Accident Lawyers: Why Firms like Osuji & Smith Lawyers Are Essential in Personal Injury Cases…

Bicycle Accidents and the Role of Osuji & Smith Personal Injury Lawyers in Calgary

Bicycle Accidents and the Role of Osuji & Smith Personal Injury Lawyers in Calgary Bicycling is both an environmentally friendly…

A Long Road: Maryam’s Story

I moved from Pakistan to Canada 14 years ago to pursue my Ph.D. and a career in academia. I never…

ATV Accidents Lawyers in Calgary: How Osuji & Smith Personal Injury Lawyers Can Help

ATV Accidents Lawyers in Calgary: How Osuji & Smith Personal Injury Lawyers Can Help ATVs (All-Terrain Vehicles) offer an exhilarating…

Latent Prospects: Priya’s Story

It was in terminal 1 at the Frankfurt Airport when I realized I could not turn back. I was halfway…

A Journey of Dreams, Determination, and Success: Ahmed’s Story

This story begins in the vibrant streets of Dhaka, Bangladesh, where Ahmed discovered his passion for business studies. Driven by…

Getting HELP From Osuji & Smith Lawyers in Calgary for Motor Vehicle Accidents

Getting HELP From Osuji & Smith Lawyers in Calgary for Motor Vehicle Accidents Motor vehicle accidents can be traumatic, life-changing…

Job Cuts at Rogers Following Structural Changes Post Shaw Merger in Alberta

Job Cuts at Rogers Following Structural Changes Post Shaw Merger In Alberta Osuji & Smith, Calgary Employment Lawyers learned that…

Top 3 Employment Lawyers in Calgary, Alberta: Protecting Your Rights in the Workplace

Top 3 Employment Lawyers in Calgary, Alberta: Protecting Your Rights in the Workplace If you are facing workplace issues or…

Perseverance Through Struggle: Rebecca’s Story

I left my home in Moldova at 18 to pursue an education and a better life. Three years ago, I…

Did Your Employer Reduce Your Salary in Alberta? Understanding Constructive Dismissal

Did Your Employer Reduce Your Salary in Alberta? Understanding Constructive Dismissal While there is widespread understanding of the concept of…

The Rigours of Litigation in Divorce and Separation in Alberta: A Battle of Stress and Resilience

The Rigours of Litigation in DIVORCE AND SEPARATION IN ALBERTA: A Battle of Stress and Resilience Divorce and separation in…

An Exploration of Types of Employment Termination in Alberta, Canada

An Exploration of Types of Employment Termination in Alberta, Canada The relationship between employers and employees in Alberta is governed…

Top 10 Reasons Employees Get Fired in Alberta

Top 10 REASONS EMPLOYEES GET FIRED IN ALBERTA Were you TERMINATED FOR CAUSE IN ALBERTA? In Alberta, Canada, an employer…

Infidelity / Adultery as a ground to seek for a divorce in Calgary, Alberta

Infidelity / Adultery as a GROUND TO SEEK FOR A DIVORCE IN CALGARY, ALBERTA Infidelity, also known as adultery, is…

Top 10 Reasons to Seek a Divorce in Calgary, Alberta

Top 10 REASONS TO SEEK A DIVORCE IN CALGARY, Alberta Divorce is a challenging journey that one embarks upon, often…

A Past and Future of Change: Leah’s Story

I was ten when I left Zimbabwe to join my parents in Canada. They had built a life for us…

Are you looking for a Calgary lawyer but unsure about the specific legal specialty you need?

Are you looking for a Calgary lawyer but unsure about the specific legal specialty you need? Choosing the right Calgary…

The Role of Sexual Harassment Lawyers in Calgary, AB: A Focus on Osuji & Smith Employment Lawyers

The Role of SEXUAL HARASSMENT LAWYERS IN CALGARY, AB: A Focus on OSUJI & SMITH EMPLOYMENT LAWYERS In Alberta, sexual…

Calgary Lawyers: A Comprehensive Overview of Employment Law, Family Law, and Personal Injury Law at Osuji & Smith

CALGARY LAWYERS: A Comprehensive Overview of EMPLOYMENT LAW, FAMILY LAW, and PERSONAL INJURY LAW at Osuji & Smith Calgary, as…

The Importance of a Real Estate Lawyer in Calgary Alberta

The Importance of a REAL ESTATE LAWYER IN CALGARY The role of a real estate lawyer in any real estate…

Osuji & Smith Lawyers: Pioneers of Legal Excellence in Calgary

Osuji & Smith Lawyers: Pioneers of Legal Excellence in Calgary Osuji & Smith Lawyers, a legal powerhouse based in Calgary,…

Quiet Firing: Its Implications and Legality in Alberta and Canada

Quiet Firing: Its Implications and Legality in Alberta and Canada Is QUIET FIRING legal in Canada? The short answer is…

Understanding Temporary Layoffs in Alberta

Understanding Temporary Layoffs in Alberta In Alberta, the maximum duration of a temporary layoff is 90 days in a 120-day…

Suncor to cut 1,500 jobs by the end of 2023 to reduce costs and improve the company’s financial performance

Suncor to cut 1,500 jobs by the end of 2023 to reduce costs and improve the company’s financial performance Suncor…

Emotional Abuse and Legal Assistance in Alberta: Navigating the Terrain with a Family Lawyer

Emotional Abuse and Legal Assistance in Alberta: Navigating the Terrain with a Family Lawyer Emotional abuse is a pervasive and…

A Comprehensive Look at Top Personal Injury Lawyers in Calgary: Spotlight on Osuji & Smith Lawyers Accident Injury Lawyers Calgary

A Comprehensive Look at Top Personal Injury Lawyers in Calgary: Spotlight on Osuji & Smith Lawyers Accident Injury Lawyers Calgary…

Understanding Labor and Employment Law in Alberta

Understanding Labor and Employment Law in Alberta Labor and employment law in Alberta, Canada, plays a crucial role in safeguarding…

Understanding and Addressing Hostile Work Environment Retaliation in Alberta

Understanding and Addressing Hostile Work Environment Retaliation in Alberta In an ideal world, workplaces are environments of collaboration and shared…

Family Violence and Protection Orders in Calgary: Safeguarding Families in Need

FAMILY VIOLENCE AND PROTECTION ORDERS IN CALGARY: Safeguarding Families in Need Family violence is an all-too-common issue that impacts countless…

Costs of Divorce in Alberta: What to Expect

Costs of DIVORCE IN ALBERTA: What to Expect Family Lawyers Calgary – FAMILY LAW Questions And Answers Divorce can be…

The Emotional Terrain of Divorce in Alberta: A Look at Different Resolution Methods

The Emotional Terrain of DIVORCE IN ALBERTA: A Look at Different Resolution Methods The breakdown of a marriage is a…

THE CONTINOUS OBLIGATION OF GOOD FAITH AND LOYALTY IN ALBERTA: HAVING A CONFLICT-OF-INTEREST POLICY

THE CONTINOUS OBLIGATION OF GOOD FAITH AND LOYALTY IN ALBERTA: HAVING A CONFLICT-OF-INTEREST POLICY The continuous obligation of good faith…

Is Your Workplace Toxic? What You Need to Know About Workplace Harassment and Discrimination in Alberta

IS YOUR WORKPLACE TOXIC? What You Need to Know About WORKPLACE HARASSMENT AND DISCRIMINATION IN ALBERTA Have you ever worked…

The Legal Risks of Quitting Your Job to Start Your Business in Alberta

The LEGAL RISKS OF QUITTING YOUR JOB in Alberta to START YOUR BUSINESS IN ALBERTA Deciding to quit your job…

Adapting to a New Life: Saira’s Story

I moved to Canada around 2001 from a small village in Pakistan. Our life mainly consisted of walking to school…

Osuji & Smith along with 3 of our lawyers won HR Reporter’s Best Employment Lawyers

Osuji & Smith along with 3 of our lawyers won HR Reporter’s BEST EMPLOYMENT LAWYERS So proud to share that…

Seeking Opportunities: Ayaan’s Story

If I had to pick one word to describe my immigration story and all that followed, it would be “opportunities.”…

From Severity, Mercy is Born: Farah’s Story

I moved from Turkey to Canada in December 2017 with my mother and brothers. Although I migrated from Turkey, I…

My landlord has given me a 24-hour eviction notice. Is that even legal in Alberta?

My landlord has given me a 24-HOUR EVICTION NOTICE. Is that even legal in Alberta? In Alberta, landlords can evict…

Calgary EMPLOYMENT CONTRACTS: BEYOND WRITTEN TERMS

EMPLOYMENT CONTRACTS: BEYOND WRITTEN TERMS There is a proverb that goes, “A snake that you can see, does not bite.”…

Legal risks of starting a family business in Alberta

Legal risks of STARTING A FAMILY BUSINESS IN ALBERTA Running a business with your family can have several advantages. For…

Moving Through Motifs: Jason’s Story

Some moments in this life don’t last long, but overstay their welcome. They feel less like a chapter or lesson…

Watch Out for the Termination Clause in Alberta! Termination Clause in an Employment Contract

Watch Out for the Termination Clause in Alberta! Termination Clause in an Employment Contract Congratulations! You have secured your dream…

On Learning and Growing: Zareen’s Story

I moved to Canada in 2019 from the United Arab Emirates (UAE) for university on a study permit. I have…

A Lifelong Student: Jose’s Story

I was fortunate enough to be born into a middle-class family in Peru. I grew up learning English and even…

AI Disrupts the Legal Market: Will ChatGPT Make Lawyers Obsolete?

AI Disrupts the Legal Market: Will ChatGPT Make LAWYERS Obsolete? Believe it, with a series of prompts, for example, Chat…

Time Theft – Things to Know

Time Theft – Things to Know EMPLOYERS CAN SUE EMPLOYEES FOR TIME THEFT, BRITISH COLUMBIA COURT CONFIRMS Despite numerous benefits…

My employer refuses to accommodate my childcare obligations. Can I do anything about this in Alberta?

My employer refuses to accommodate my childcare obligations. Can I do anything about this in Alberta? The short answer is…

Termination of Employment – Importance of a Clear Termination Clause in Alberta

TERMINATION OF EMPLOYMENT – IMPORTANCE OF A CLEAR TERMINATION CLAUSE IN ALBERTA Where an employer terminates the employment of an…

Cutting Your Losses: The Duty to Mitigate in Wrongful Dismissal Lawsuits in Alberta

Cutting Your Losses: THE DUTY TO MITIGATE IN WRONGFUL DISMISSAL LAWSUITS IN ALBERTA A recent King’s Bench case shows that…

The Future of Contracting and Good Faith in Alberta

THE FUTURE OF CONTRACTING and GOOD FAITH IN ALBERTA The SCC’s Decision in C.M. Callow Inc. v Zollinger Good faith…

A Glimmer of Hope: Emin’s Story

I moved from Turkey a year after the Turkish Government started mass targeting my community. As a result of this,…

As a United Way Ambassador, Charles Osuji advocates for a clear pathway to integrate new community members

As a UNITED WAY AMBASSADOR, Charles Osuji advocates for a clear pathway to integrate new community members A BETTER TOMORROW:…

Divorce and Relocation in Alberta

DIVORCE AND RELOCATION IN ALBERTA After Divorce, shared parenting could be tough on you, then your ex-spouse being the primary…

How to lead a Black-owned, minority-led law firm, and fastest growing law firm in Alberta

How to lead a Black-owned, minority-led law firm, and fastest-growing law firm in Alberta Charles Osuji is a multi-award-winning lawyer…

Comfort in Chaos: Nakul’s Story

I moved to Canada three years ago from India on a study permit. It wasn’t my first choice, but due…

3 Things to consider before popping the big question this Valentine’s Day

DO I NEED A PRENUPTIAL AGREEMENT? 3 Things to consider before popping the big question this Valentine’s Day What’s in…

Happy Black History Month! Black History Month Speaker Series: A Conversation with Calgary Lawyer Charles Osuji

Happy Black History Month! Black History Month Speaker Series: A Conversation with Calgary Lawyer Charles Osuji Our very own Charles…

The Biggest Sky: Benjamin’s Story

My family dreamed of coming to Canada for so long that when the day finally arrived, I could not quite…

Calgary Employment Law Services

CALGARY EMPLOYMENT LAW SERVICES Do some of these employment law issues sound familiar? Having a reliable and trustworthy employment lawyer…

Keynote Speaker: CHARLES OSUJI – CRIEC is hosting an event to speak on this year’s theme for Black History Month

Keynote Speaker: CHARLES OSUJI – CRIEC is hosting an event to speak on this year’s theme for Black History Month…

In Search of Home: Viraj’s Story

Moving to a new country is never easy. I knew early in my life that I wanted to leave India….

Calgary Lawyer Charles Osuji: From law school in Nigeria to law firm CEO in Calgary – LevelUP by AfricaX Media Full Interview

CALGARY LAWYER CHARLES OSUJI: From law school in Nigeria to law firm CEO in Calgary – LevelUP by AfricaX Media…

Growing Closer Through Hardship: Ashraf’s Story

I was only two when my family moved from Afghanistan to Tajikistan. Three short years later, we moved to Calgary…

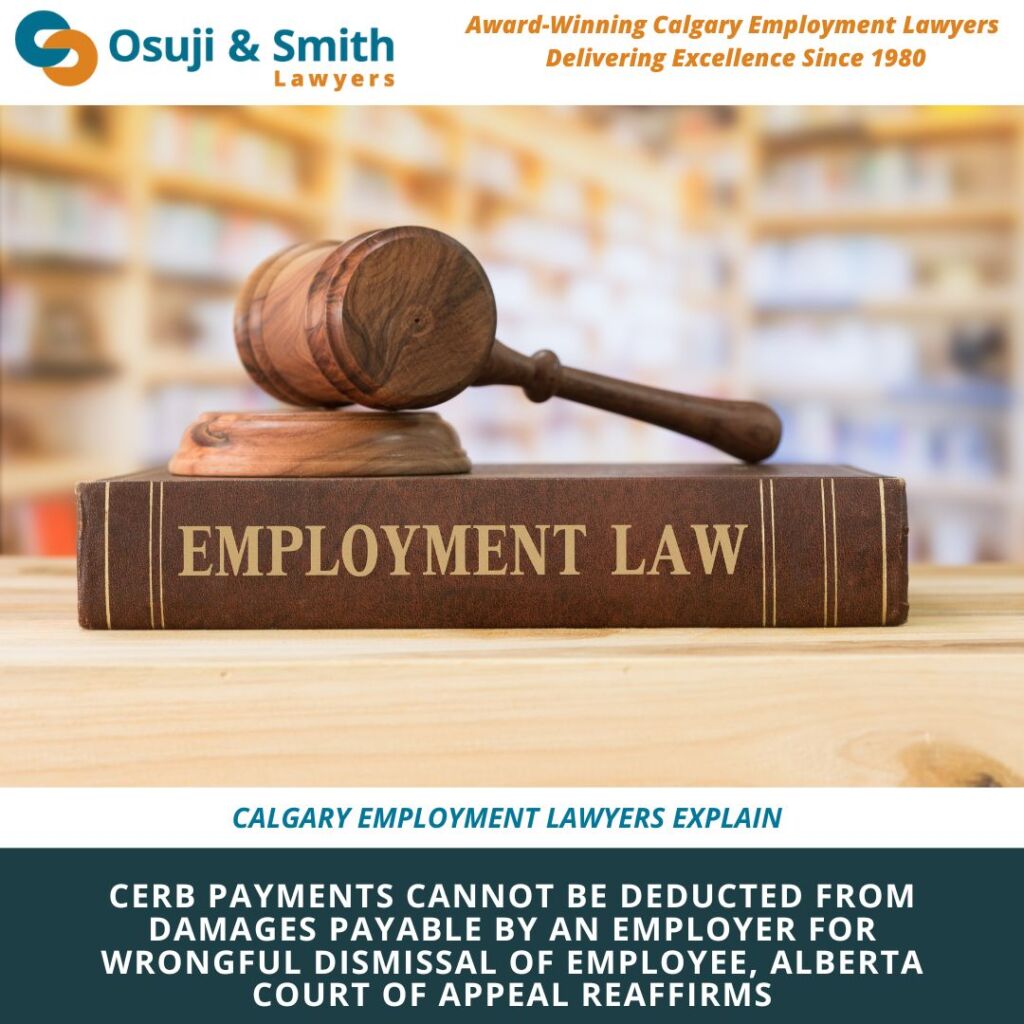

CERB PAYMENTS CANNOT BE DEDUCTED FROM DAMAGES PAYABLE BY AN EMPLOYER FOR WRONGFUL DISMISSAL OF EMPLOYEE, ALBERTA COURT OF APPEAL REAFFIRMS

CERB PAYMENTS CANNOT BE DEDUCTED FROM DAMAGES PAYABLE BY AN EMPLOYER FOR WRONGFUL DISMISSAL OF EMPLOYEE, ALBERTA COURT OF APPEAL…

A Sense of Home: Akia’s Story

My family moved to Canada in 2005 from Denmark. I was born a Danish citizen but soon gained dual citizenship…

At Osuji & Smith Lawyers in 2023, we are ready to help our clients even more!

In the last 3 months, we have added 15 grounded, mature and experienced professionals to our rapidly growing law firm…

Charles Osuji – Osuji & Smith Lawyers, Calgary’s 2023 ThreeBestRated® Award Winning Law Firm Explains Breach Of Contract

Charles Osuji – Osuji & Smith Lawyers, Calgary’s 2023 ThreeBestRated® Award Winning Law Firm Explains Breach Of Contract A contract…

Can a business sue you for leaving a negative Google review?

Can a business sue you for leaving a negative Google review? Google reviews are crucial to effective online marketing. Statistics…

Unexpected Kindness: David’s Story

Our transition from China took place when I was about seven years old; I was so young that I can…

Lost in Translation: Emma’s Story

Language is a way of communicating who you are: a way of letting the world know how you feel. When…

Lifelong Friends: Adrian’s Story

Our transition from the Philippines to Canada took place when I least expected it, and at a time when I…

7 Important Things You Should Know Before Buying or Selling a Business in Calgary

7 Important Things You Should Know Before Buying or Selling a Business in Calgary Calgary is a city of entrepreneurs….

Reinventing My Future: Sharmin’s Story

Growing up, I never felt that I belonged anywhere or had my own unique sense of identity. I joined a…

Calgary Lawyer Charles Osuji – Foot in the Door Program – Calgary Eyeopener with Angela Knight Interview on CBC Radio

CALGARY LAWYER CHARLES OSUJI – Foot in the Door Program – CALGARY EYEOPENER WITH ANGELA KNIGHT INTERVIEW ON CBC RADIO…

Shifting Support Systems: Analyn’s Story

Our transition from the Philippines to Canada took place when I was 14 years old. My siblings, my parents, and…

Snowfall and slip and fall claims in Calgary – I SLIPPED AND FELL; WHO DO I SUE?

Snowfall and slip and fall claims in Calgary – I SLIPPED AND FELL; WHO DO I SUE? While many parts…

Calgary Lawyer Charles Osuji was a keynote speaker at the Immigrant Services Calgary award ceremony

Calgary Lawyer Charles Osuji was a keynote speaker at the Immigrant Services Calgary award ceremony Inspiring the world! Charles Osuji…

Trick or Treat! The Alberta Court of Appeal performed a Trick to give Alberta parents a Treat

Trick or Treat! On October 31, 2022, the Alberta Court of Appeal performed a Trick to give Alberta parents a…

Finding Heart in a New Home: Hassan’s Story

Moving to Canada has been a roller-coaster of new experiences. From learning cultural norms to trying foreign foods for the…

Surrender of Choice: Poppy’s Story

If you asked me to describe my life in a word, I would choose ‘wonderful’ without hesitation. Sometimes I miss…

Calgary Black-owned law firm becomes largest in Alberta, one of largest in Canada

Calgary Black-owned law firm becomes largest in Alberta, one of largest in Canada Calgary law firm Osusji and Smith Lawyers…

Changing Perspectives and the Pandemic: Linda’s Story

My family and I immigrated from China in 1995 when I was 20 years old. I made new friends in…

BACK-TO-SCHOOL!!! CO-PARENTS AND SCHOOL: WHO PAYS FOR WHAT?

BACK-TO-SCHOOL!!! CO-PARENTS AND SCHOOL: WHO PAYS FOR WHAT? For families, September can be a stressful month as children go back…

Sources of Strength: Aryan’ s Story

I wonder what motivates people to move: to restart their life in a country with a cold and hostile terrain….

Calgary’s Well-Renowned Employment Law Firm, Osuji & Smith Lawyers, Wins the 2022 ThreeBestRated® Award for Best Employment Lawyers

CALGARY’S WELL-RENOWNED EMPLOYMENT LAW FIRM, OSUJI & SMITH LAWYERS, WINS THE 2022 THREEBESTRATED® AWARD FOR BEST EMPLOYMENT LAWYERS No one…

Embracing Change: Beatrice’s Story

When I first came to Manitoba some 70 years ago seeking only an education, I could not have anticipated what…

Osuji & Smith Place – Osuji & Smith Calgary Lawyers

OSUJI & SMITH PLACE – OSUJI & SMITH LAWYERS CALGARY “Give me a place to stand, and I will move…

Alberta Employment Standards Appeal Victory by Osuji & Smith

Alberta Employment Standards Appeal Victory by Osuji & Smith After winning a landmark Alberta employment case in spring, Charles Osuji,…

Shocking New Beginnings: Amela’s (Parents’) Story

Although the people in Canada are generally accepting of diverse newcomers, it was hard adapting to life in Canada because,…

Weaving New Narratives: Gabriela’s Story

Children grow up in a world of their parents’ making. Life can be callous, and so they try to keep…

Choosing my own Adventure: Natasha’s Story

My father stood in the kitchen when he told us we would be leaving for good; it took until we…

Osuji and Smith Lawyers – Calgary Office is Expanding

EXCITING NEWS!! WE ARE EXPANDING!!! Effective September 6, 2022, Osuji & Smith will be expanding to a second location –…

Can I be Terminated…for Cause in Alberta?

Can I be Terminated…for Cause in Alberta? CALGARY EMPLOYMENT LAWYER explains Despite employers’ practices, policies and/or procedures which may state…

Helping Hands: Aminah’s Story

My family has suffered immense suffering and turmoil as a result of the current situation in Syria; it is impossible…

“I QUIT! Not!”- You said it but did you mean it? Elements of a valid resignation in Alberta

“I QUIT! Not!”- You said it but did you mean it? ELEMENTS OF A VALID RESIGNATION IN ALBERTA Okay, let’s…

Groundbreaking Severance Ruling Landmark Victory For Calgary Employment Law Firm

Alberta employment decision considers ‘holistic’ work history in awarding claim Groundbreaking Severance Ruling Landmark Victory For CALGARY EMPLOYMENT LAW FIRM…

Parenting, Guardianship, Custody & Access: What does it mean in Alberta Family Law?

Parenting, Guardianship, Custody & Access: What does it mean in Alberta Family Law? What’s the difference between a parent and…

LOST AND DELAYED LUGGAGE: YOUR RIGHTS AS AN AIR PASSENGER

LOST AND DELAYED LUGGAGE: YOUR RIGHTS AS AN AIR PASSENGER If you arrive at your destination only to discover that…

Can I refuse a request by my Employer to disclose my personal medical information?

Can I refuse a request by my Employer to disclose my personal medical information? Consider the following scenario: You’re seeking…

Discrimination in the Workplace: What is it? What should I do about it?

DISCRIMINATION IN THE WORKPLACE: What is it? What should I do about it? In Alberta, you’re protected against discrimination in…

A five-step guide to summer access scheduling – Custody and parenting arrangements vary from family to family

A five-step guide to summer access scheduling – CUSTODY AND PARENTING ARRANGEMENTS VARY FROM FAMILY TO FAMILY Two household summers…

What are my rights to Minimum Pay, Vacation, and Holiday Pay in Alberta?

WHAT ARE MY RIGHTS TO MINIMUM PAY, VACATION, AND HOLIDAY PAY IN ALBERTA? In Alberta, the rights of employees to…

TERMINATION OF EMPLOYMENT AND DUTY TO MITIGATE

TERMINATION OF EMPLOYMENT AND DUTY TO MITIGATE In the assessment of damages for breach of an indefinite employment agreement, courts…

What are the roles, rights, and responsibilities of a shareholder or director in a corporation?

What are the roles, rights, and responsibilities of a shareholder or director in a corporation? In Alberta, the Alberta Business…

What are the benefits of a Unanimous Shareholder Agreement?

What are the benefits of a Unanimous Shareholder Agreement? Did you know there are different types of shareholder agreements? In…

He/She/They : Misgendering employees is a ground for Human Rights Complaint

He/She/They : Misgendering employees is a ground for Human Rights Complaint Our pronouns are often based on appearance or name,…

Nothing is FREE! Not Even in FREETOWN! – Legalities of taking up free internship

Nothing is FREE! Not Even in FREETOWN! – Legalities of taking up free internship Internships are paid and unpaid positions…

Your Employer has changed the terms of your Contract: What can you do?

YOUR EMPLOYER HAS CHANGED THE TERMS OF YOUR CONTRACT: What can you do? Employers may see the need to alter…

Duty to Accommodate Mental Illness in the Workplace

Duty to Accommodate MENTAL ILLNESS IN THE WORKPLACE Feeling stressed and anxious at work? Having thoughts of self-harm? Do you…

What makes a will valid in Alberta?

What makes a will valid in Alberta? Almost half of all Canadians don’t have a will, according to the Government…

Workplace Bring-Your-Own-Device Policies Provide Employees With Privacy Protection Under the Charter

Workplace Bring-Your-Own-Device Policies Provide Employees With Privacy Protection Under the Charter Bring your own device (BYOD), also called bring your…

Who is obligated to pay child support?

Who is obligated to pay CHILD SUPPORT? Are you in a relationship with someone who has a child, and concerned…

TOUCH ME NOT – Tort of Conversion and other tort liabilities for interfering with the property of another

TOUCH ME NOT – Tort of Conversion and other tort liabilities for interfering with the property of another Have you…

Consent to Medical Treatment, Counselling, and Care

Consent to Medical Treatment, Counselling, and Care Prior to conducting physical exams, tests, surgeries, etc., healthcare providers and professionals need…

Groundbreaking severance ruling in landmark Alberta case by Osuji & Smith Employment Lawyers

Groundbreaking severance ruling in landmark Alberta case by Osuji & Smith Employment Lawyers For the first time in Alberta, a…

Negligent Misrepresentation During the Hiring Process

Negligent Misrepresentation During the Hiring Process Recruiting is often an opportunity to showcase the hopes and dreams of employers and…

Is this non-competition clause reasonable?

Is this non-competition clause reasonable? It’s common for an employer to ask you to sign a non-competition clause as part…

Osuji & Smith Lawyers, calgary employment lawyers obtained a judgment for 2 years severance termination pay rarely granted in-alberta

Osuji & Smith calgary employment lawyers obtained a judgment for 2 years severance termination pay rarely granted in-alberta for a…

How to Resolve a Shareholder Dispute in Alberta

How to Resolve a Shareholder Dispute in Alberta A shareholder is any individual or institution with a financial interest in…

Upholding greater diversity in the legal profession: Charles Osuji of Osuji and Smith Lawyers

Upholding greater diversity in the legal profession: Charles Osuji of Osuji & Smith Lawyers Osuji shares his story of immigration,…

Can I refuse to tell my employer my vaccination status as it infringes my privacy rights?

Can I refuse to tell my employer my vaccination status as it infringes my privacy rights? Canada as a whole…

I was fired. Should I sign the release?

I was fired. Should I sign the release? It’s common for an employer to ask you to sign a release…

FIXED TERM EMPLOYMENT AGREEMENT AND TERMINATION NOTICE

FIXED TERM EMPLOYMENT AGREEMENT AND TERMINATION NOTICE Every employment agreement can be terminated, even those that do not contain a…

Am I In an Adult Interdependent Relationship?

Am I In an Adult Interdependent Relationship? Akin to married and common law couples, unmarried couples in Alberta, who are…

Parenting – Who has the Final Say in Alberta Child Parenting Laws?

Parenting – Who has the Final Say in Alberta Child Parenting Laws? It’s a no-brainer that lawful parenting of the…

How to Prove a Common Law Relationship in Alberta

How to Prove a Common Law Relationship in Alberta The rights and obligations of people in a common law relationship…

Building for success: Tips from lawyer and entrepreneur Charles Osuji

Building for success: Tips from lawyer and entrepreneur Charles Osuji Running a law firm is no child’s play. You are…

Osuji and Smith Lawyers Voted Calgary’s Top Choice Business Law Service of 2022

Osuji and Smith Lawyers Voted Calgary’s Top Choice Business Law Service of 2022 AND WE DID IT! 🥂 This award…

Justice in Pieces Guest Speaker Series: Charles Osuji

JUSTICE IN PIECES Guest Speaker Series: Charles Osuji Speaking with Charles Osuji about his practice, and the tremendous amount…

Entrepreneur TV powered by Rogers TV – Charles Osuji the CEO and Managing Partner of Osuji & Smith Lawyers Interview

Charles Osuji the CEO and Managing Partner of Osuji & Smith Lawyers interviewed on Entrepreneur TV powered by Rogers TV…

Lexpert Rising Stars 2021 – Charles Osuji, Managing Partner, Osuji & Smith Lawyers

Lexpert Rising Stars 2021 – Charles Osuji, Managing Partner, Osuji & Smith Lawyers Charles Osuji on the importance of grace,…

In Loco Parentis: What are the Rights & Obligations of a Non-Parent in Family Law?

In Loco Parentis: What are the Rights & Obligations of a Non-Parent in FAMILY LAW? In loco parentis refers to…

Real Property Report: What is it? Who needs it? How to get it?

Real Property Report: What is it? Who needs it? How to get it? You’ve heard of a Real Property Report,…

Limits on the enforcement of company policies and procedures

Limits on the enforcement of company policies and procedures Companies’ policies and procedures are designed to regulate their operation. What…

Transition from a contractor to an employee

Transition from a contractor to an employee Under common law, an employer is required to provide an employee reasonable notice…

How do long-term disability benefits affect severance pay in Alberta?

How do LONG-TERM DISABILITY BENEFITS affect SEVERANCE PAY IN ALBERTA? If you receive long-term disability benefits, your severance pay could…

And we are back! Here are some of our very high-level goals!

And we are back! Here are some of our very high-level goals! We are so excited for what this year…

One big highlight of 2021?! Celebrating the 80th birthday of our founding partner, the one and only, Jim Smith!

One big highlight of 2021?! Celebrating the 80th birthday of our founding partner, the one and only, Jim Smith! 🥳…

One of Calgary’s Top Lawyers Charles Osuji Recipient of Prestigious Awards in 2021

ONE OF CALGARY’S TOP LAWYERS CHARLES OSUJI RECIPIENT OF PRESTIGIOUS AWARDS IN 2021 Few years ago, Charles Osuji was a…

Libel and Slander in the era of Social Media

LIBEL AND SLANDER IN THE ERA OF SOCIAL MEDIA – Defamation It takes years to build a good reputation, and…

What constitutes a valid resignation by law in Alberta?

What constitutes a valid resignation by law in Alberta? To protect employees’ rights, Alberta law obligates employers to meet certain…

2021 Top 25 DEI Person of the Year Award by Canadian Multicultural Group

CALGARY LAWYER CHARLES OSUJI is the recipient of the 2021 TOP 25 DEI PERSON OF THE YEAR AWARD BY CANADIAN…

Public disclosure of private facts

PUBLIC DISCLOSURE OF PRIVATE FACTS We all know becoming “Facebook official” is a pivotal moment for new couples. Publicly changing…

Protect yourself from the Abuser – EPOs

Protect yourself from the Abuser – EPOs CALGARY FAMILY LAW LAWYERS Can Help The statistics are pretty alarming! In 2019,…

Lexpert Rising Stars 2021: Canada’s Leading Lawyers Under 40

Lexpert Rising Stars 2021: Canada’s Leading Lawyers Under 40 In 2011, Charles Osuji uprooted himself — and his developing…

The Thin Skull Rule – EMPLOYERS TAKE THEIR EMPLOYEE’S AS THEY FIND THEM

The Thin Skull Rule – EMPLOYERS TAKE THEIR EMPLOYEE’S AS THEY FIND THEM The Thin Skull Rule is known for…

Alberta Court grants summary judgment for revenge porn

Alberta Court grants summary judgment for revenge porn – Calgary Lawyers for Public Disclosure of Private Facts The Alberta Court…

Celebrating Jim Smith’s 80th Birthday! The man that started it all.

🎉 Celebrating JIM SMITH’s 80th Birthday! The man that started it all. Our team threw together an AMAZING surprise party…

Calgary Employment Lawyers on What are the employment law implications of employees working remotely

CALGARY EMPLOYMENT LAWYERS on What are the employment law implications of employees working remotely What are the employment law implications…

Charles Osuji | Top 40 Under 40 2021

CHARLES OSUJI | TOP 40 UNDER 40 2021 Charles Osuji champions diversity at his law firm and mentors other immigrants…

A SYNOPTIC LEGAL ANALYSIS OF NON-COMPETE CLAUSES IN EMPLOYMENT CONTRACTS

A SYNOPTIC LEGAL ANALYSIS OF NON-COMPETE CLAUSES IN EMPLOYMENT CONTRACTS Introduction It is realistically presumptive that in the effort of…

Courts’ Intolerance for Employers’ Post-Termination Behavior

Courts’ Intolerance for Employers’ Post-Termination Behavior A recent Ontario Superior Court decision reminds employers that they can be held liable…

Should I get my employment contract reviewed by a lawyer?

Should I get my employment contract reviewed by a lawyer? Receiving a job offer is exciting, especially if you’ve applied…

3 Recent Just Cause Termination Cases in Alberta Important for Employers

TERMINATION FOR CAUSE: What the Employer Must Prove 3 Recent Just Cause Termination Cases in Alberta Important for Employers Alberta…

The Story Behind the Success of Multiple Award-Winning Nigerian-Canadian Lawyer “Charles Osuji”

The Story Behind the Success of MULTIPLE AWARD-WINNING NIGERIAN-CANADIAN LAWYER “CHARLES OSUJI” Three years after his call to the Alberta…

From Grass to Grace in Canada with Calgary Lawyer Charles Osuji

From Grass to Grace in Canada with CALGARY LAWYER CHARLES OSUJI Interview by Bukky Wonda

CONTRACTS – IF IT IS NOT IN WRITING, IT MAY NOT BE ENFORCEABLE

CONTRACTS – IF IT IS NOT IN WRITING, IT MAY NOT BE ENFORCEABLE Word is bond. Where there is a…

What does the law say about mandatory vaccines and employee rights in Alberta?

What does the law say about mandatory vaccines and EMPLOYEE RIGHTS IN ALBERTA? Are mandatory vaccination policies in the workplace…

Best Lawyers Ones to Watch – Calgary Lawyer Charles Osuji

Based on peer-review, and the feedback from fellow lawyers across Canada, Calgary lawyer, Charles Osuji has just been recognized…

WHEN THE EMPLOYEE’S DUTY TO MITIGATE ARISES

WHEN THE EMPLOYEE’S DUTY TO MITIGATE ARISES You are challenging your former employer for wrongfully terminating your employment and it…

Joint Venture vs Partnership

Joint Venture vs Partnership – CORPORATE LAWYERS CALGARY We often see clients who use the terms “joint venture” and “partnership”…

DIVORCE: WHO GETS WHAT IN ALBERTA

DIVORCE: WHO GETS WHAT IN ALBERTA Divorce does not have to be ugly. Believe it or not, it is possible…

CERB and Mitigation Income

CERB and Mitigation Income Under employment law, a terminated employee has a duty to take steps as a reasonable person…

Calgary Business Corporate Lawyers – Everything You Need to Know About Buying or Selling a Business in Calgary

CALGARY BUSINESS CORPORATE LAWYERS – Everything You Need to Know About Buying or Selling a Business in Calgary Buying or…

Social Questions with Osuji & Smith Lawyers Video Interview

Social Questions with Osuji & Smith Lawyers Video Interview As an immigrant coming to Canada from Nigeria in 2011, Mr….

How to Resolve Shareholder Disputes in Alberta

How to RESOLVE SHAREHOLDER DISPUTES IN ALBERTA People we work with are similar to our second family. Also, when business…

Balancing legal practice with managing a fast-growing law firm in Calgary

Balancing legal practice with managing a FAST-GROWING LAW FIRM IN CALGARY Charles Osuji is the Managing Partner and CEO of…

How does division of family property and debts work in Alberta?

How does DIVISION OF FAMILY PROPERTY and debts work in Alberta? There’s more involved in a marital separation or divorce…

Moving to a new country can be scary. Here’s what you need to know!

Moving to a new country can be scary. Here’s what you need to know! Moving to a western country is…

3 Common Problems with Employment Contracts

3 Common Problems with EMPLOYMENT CONTRACTS 3 COMMON MISTAKES WITH EMPLOYMENT CONTRACTS In the course of our work at Osuji…

Terminated on the First Day of Employment. What are your Rights

TERMINATED ON THE FIRST DAY OF EMPLOYMENT. What are your Rights WITHDRAWAL OF EMPLOYMENT BEFORE COMMENCEMENT REQUIRES REASONABLE NOTICE. It…

Parenting Challenges: How do Alberta’s Maternal and Parental Leave Rules Work?

Parenting Challenges: How do Alberta’s MATERNAL AND PARENTAL LEAVE RULES Work? Imagine you’re an employee on parental leave. Your job…

Calgary Real Estate Lawyer Explains Necessary Steps to Closing Transactions

CALGARY REAL ESTATE LAWYER Explains Necessary Steps to Closing Transactions You need a lawyer to buy or sell a home…

Our partner, Charles Osuji, recently shared his journey to becoming Canada’s Top 25 Influential Lawyers

Our partner, CHARLES OSUJI, recently shared his journey to becoming CANADA’S TOP 25 INFLUENTIAL LAWYERS DISCIPLINE OF FOCUS – JOURNEY…

Permanent Residence in Canada: Do you qualify on Humanitarian & Compassionate Grounds?

PERMANENT RESIDENCE IN CANADA: Do you qualify on Humanitarian & Compassionate Grounds? Has Canada become your home even though you…

New Family Property Act Legislation Benefits Unmarried Couples

New Family Property Act Legislation Benefits Unmarried Couples, OSUJI & SMITH FAMILY LAWYERS Report As of January 1st, 2020, the…

EMPLOYER’S DUTY OF GOOD FAITH AND FAIR DEALING

B.C. COURT OF APPEAL REMINDS US OF EMPLOYER’S DUTY OF GOOD FAITH AND FAIR DEALING About two years ago, in…

Employment Law and Covid-19

🎤KPI PODCAST #1 – Employment Law and Covid-19 In this podcast, Jean Darius of KPI Staffing and Charles Osuji of…

Estate Law: A note on “Intermedelling” – “Intermedelling” with Estate

ESTATE LAW: A note on “Intermedelling” – “Intermedelling” with Estate In my previous posts, I have repeatedly expressed the importance…

Fair Agreements: Do Workplace Policies Form Part of the Employment Contract?

Fair Agreements: Do Workplace Policies Form Part of the Employment Contract? Workplace policies are an important part of the employee/employer…

2021 Top Choice Celebration by Top Choice Awards – Starting at 5 PM MST on May 29th

2021 Top Choice Celebration by Top Choice Awards – Starting at 5 PM MST on May 29th We’re so excited…

Building for success: Tips from lawyer and entrepreneur Charles Osuji

Building for success: Tips from CALGARY LAWYER AND ENTREPRENEUR CHARLES OSUJI “I’m honored to be profiled on the CIBC national…

Do You Know the Laws Behind Layoffs and Rehiring?

Do You Know the Laws Behind Layoffs and Rehiring? Layoffs? Rehiring? Do you know the laws behind layoffs and…

Osuji & Smith Employment Lawyers Advise Calgary Employees Facing Layoffs

Osuji & Smith EMPLOYMENT LAWYERS Advise Calgary Employees Facing Layoffs Alberta employees in multiple sectors have faced unprecedented layoffs over…

Straw Buyer’s liability on Mortgage Fraud

Straw Buyer’s liability on Mortgage Fraud With the energized real estate market and soaring property values, we see an influx…

What are my rights if I have to cancel a wedding contract due to COVID-19?

What are my rights if I have to cancel a WEDDING CONTRACT due to COVID-19? Planning a wedding during the…

Calgary Family and Divorce Lawyers Questions and Answers

CALGARY FAMILY AND DIVORCE LAWYERS QUESTIONS AND ANSWERS Read more FAMILY LAW Questions And Answers Question: When can I file…

Osuji & Smith Employment Lawyers Help Calgary Employees with Top-Rated Employment Law Services

Osuji & Smith EMPLOYMENT LAWYERS Help Calgary Employees with Top-Rated Employment Law Services Osuji & Smith, an award-winning full service…

What is the difference between custody and access in Alberta family law?

What is the difference between custody and access in Alberta family law? Custody and access are basic elements of family…

Are you a Gig-Worker? The Government of Canada wants you to share your views

Are you a Gig-Worker? The Government of Canada wants you to share your views In this blog, I thought to…

Termination of Employment while on Medical Leave

TERMINATION OF EMPLOYMENT while on Medical Leave Were you terminated while on medical leave? Then, you may be wondering whether…

What is parental alienation?

What is parental alienation? Divorce is stressful for both parents and children. During this turbulent time, emotions run high and…

What is an Employer’s Duty to Accommodate?

What is an Employer’s Duty to Accommodate? Section 7 of the Alberta Human Rights Act prevents discrimination against an employee…

Start-up Visa Program (SUV) – Is this the right program for me?

Start-up Visa Program (SUV) – Is this the right program for me? If you are an entrepreneur who wishes to…

Employee time theft while working remotely

EMPLOYEE TIME THEFT while working remotely With the COVID-19 pandemic, many employers switched to working remotely. For some employers, this…

What should you do after a slip-and-fall accident in Calgary?

What should you do after a slip-and-fall accident in calgary? PERSONAL INJURY LAWYERS answer Alberta is known for its harsh…

What business owners CAN and CAN’t do when it comes to employment rights, the vaccine, and Covid-19

What business owners CAN and CAN’t do when it comes to EMPLOYMENT RIGHTS, THE VACCINE, AND COVID-19 What does the…

Questions And Answers On Employment Issues Related To Vaccines At The Workplace

Questions And Answers On Employment Issues Related To Vaccines At The Workplace What does the law say about mandatory vaccines…

Congratulations to Charles for winning our “Amazing Boss” trophy!

Congratulations to Charles for winning our “Amazing Boss” trophy! 🏆 Thanks for all you do for us 👏🏿🤍

COVID-19 Resources to Help Small Businesses Adapt, Survive, and Thrive

COVID-19 Resources to Help Small Businesses Adapt, Survive, and Thrive Struggling to keep your business open during lockdown? Or perhaps…

Employee Dismissal: What is the Employer’s Duty of Good Faith?

Employee Dismissal: What is the Employer’s Duty of Good Faith? Losing your job can be a traumatic experience. Alberta employers…

Resealing of Probate / Administration

Resealing of PROBATE / AdministratioN When a person dies with a will, the personal representative appointed in the will of…

Fixed-Term Employment Agreement and Damages

Fixed-Term Employment Agreement and Damages As a default rule, employees are deemed hired for an indefinite term under common law….

It’s time to talk about workplace bullying – Charles Osuji on CBC Radio One Calgary

IT’S TIME TO TALK ABOUT WORKPLACE BULLYING – EMPLOYMENT LAWYER CHARLES OSUJI ON CBC RADIO ONE CALGARY Toxic workplaces are…

Calgary Employment Lawyers – The Termination of a Probationary Employee

CALGARY EMPLOYMENT LAWYERS – The Termination of a Probationary Employee There exists a common misconception amongst employees that probationary employees…

Which form of business would be good for you? Sole proprietorship, partnership, or corporation

Which form of business would be good for you? Sole proprietorship, partnership, or corporation In Canada, the legal structure of…

From Immigrant to Canada’s Top 25 Most Influential Lawyer – Charles Osuji

From Immigrant to Canada’s Top 25 Most Influential Lawyer – Charles Osuji Charles Osuji is the Managing Partner and Chief…

Termination of employment due to dishonesty – When can my boss fire me for dishonesty?

TERMINATION OF EMPLOYMENT due to dishonesty – When can my boss fire me for dishonesty? You may have tweaked your…

2021 Calgary Top Choice Award for Business Services & 2021 Three Best Rated’s “Top 3 Rated” Lawyers in Calgary

2021 Calgary Top Choice Award for Business Services & 2021 Three Best Rated’s “Top 3 Rated” Lawyers in Calgary in…

E-torts: Defamation on the Internet – 8 Things You Need to Know About Internet Defamation in Alberta

E-torts: Defamation on the Internet – 8 Things You Need to Know About Internet Defamation in Alberta People say awful…

Charles Osuji, one of the leading Business lawyers from Calgary, talks about the benefits of hiring a lawyer when starting a business

Charles Osuji, one of the leading Business lawyers from Calgary, talks about the benefits of hiring a lawyer when starting…

What is Termination For Just Cause?

What is Termination For Just Cause? Terminating an employee is never easy. For a company to terminate an employee legally,…

I was fired for time theft. Is this legal?

I was fired for time theft. Is this legal? The Question I’ve recently been terminated from my employment, where I…

Do You Need a Lawyer to Buy or Sell a House in Alberta?

Do You Need a Lawyer to Buy or Sell a House in Alberta? Major life events typically involve a team….

Meet Charles Osuji, Multiple Award-Winning Nigerian Making Global Impact With His Successes In Canadian Law Space

Meet Charles Osuji, Multiple Award-Winning Nigerian Making Global Impact With His Successes In Canadian Law Space Charles Osuji is not…

Restrictive Covenants – Is Your Non-Competition Clause Enforceable?

Restrictive Covenants – Is Your Non – Competition Clause Enforceable? Restrictive Covenants, also known as restraints against trade, are restrictions…

Can I immigrate to Canada as an Athlete?

Can I immigrate to Canada as an Athlete? Immigration Lawyers Calgary Explain If you are an athlete or a coach…

Osuji & Smith Lawyers Nominated For Top Choice Business Law Services of 2021 in Calgary

Osuji & Smith Lawyers Nominated For Top Choice Business Law Services of 2021 in Calgary Vote Today for a Chance…

LAWYER CHARLES OSUJI FEATURED ON REFINED NG…POSITIVE VOICES MAGAZINE

LAWYER CHARLES OSUJI FEATURED ON REFINED NG…POSITIVE VOICES MAGAZINE Charles Osuji is the Managing Partner and Chief Executive Officer of…

Charles Osuji awarded the 2020 Immigrant of Distinction (Achievement Under 35) Award by Immigrant Services Calgary

Charles Osuji awarded the 2020 Immigrant of Distinction (Achievement Under 35) Award by Immigrant Services Calgary

Best Interest of a Child in Parenting and Custody Disputes

Best Interest of a Child in Parenting and Custody DisputeS Child Parenting Lawyers Calgary – Child Custody Lawyers Calgary In…

Calgary Divorce Lawyers – Can A Marriage Be Annulled? Annulment Of A Marriage

Calgary Divorce Lawyers – Can A Marriage Be AnnuLled? Annulment Of A Marriage A divorce is the dissolution of an…

Deferring Vacation Entitlement – 2020 is coming to an end – Have you used your vacation days?

Deferring Vacation Entitlement – 2020 is coming to an end – Have you used your vacation days? Most of us…

How Can Vulnerability Impact Severance Pay?

How Can Vulnerability Impact Severance Pay? Severance pay, often referred to as a “severance package”, is an amount some employees…

Got a legal question? Get answers from the common’s legal clinic

Got a legal question? Get answers from the common’s legal clinic Presented By: Charles Osuji Managing Partner at Osuji and…

The Supreme Court of Canada’s Recent Ruling & What it Means for Employment Termination

CALGARY EMPLOYMENT LAWYERS, OSUJI & SMITH explain the Supreme Court of Canada’s recent ruling & what it means for employment…

Workplace Harassment and Constructive Dismissal

Workplace Harassment & Constructive Dismissal LAWYERS in CALGARY Workplace harassment in Canada is high. Nearly 20% of Canadian employees reported…

Charles Osuji shared his view on diversity, racism, entrepreneurship and his recognitions

Lawyer Charles Osuji shared his view on diversity, racism, entrepreneurship and his recognitions A few days ago, Lawyer Charles Osuji…

5 Important Things You Need to Know About Trustees

Estate planning sometimes includes a trust which is legal protection of your property to ensure it is distributed or managed…

Employers Duty to Accommodate Employees With Disabilities

To what extent does an employer need to fulfill its duty to accommodate employees with disabilities? The duty of an…

Minor Injury: A “Capped Claim”

PERSONAL INJURY LAWYERS CALGARY EXPLAINS – Minor Injury: A “Capped Claim” Background: In 2004, Alberta enacted the Minor Injury Regulation…

Role of technology in ascertaining liability in Motor Vehicle Accident Claims

Personal injury lawyers Calgary, Osuji & Smith explain: Role of technology in ascertaining liability in motor vehicle accident claims. Scientific…

Nigerian Born Calgary Employment & Business Lawyer Named in Top 25 Most Influential Lawyers in Canada

Nigerian Born Calgary Employment & Business Lawyer Named in Top 25 Most Influential Lawyers in Canada News provided by: Osuji…

Suncor Energy Layoffs: Read This Before You Sign a Release

Suncor Energy recently announced plans to cut 15% of its workforce. That’s nearly 2,000 people. If you’re a Suncor Energy…

Employment Agreement and The Minimum Standards

The Employment Standards Code provides the minimum standards that must be followed by employers and employees. It is designed to…

10 Things You Need to Know About Workplace Bullying & Harassment in Alberta

10 Things You Need to Know About Workplace Bullying & Harassment in Alberta Bullying is not strictly a childhood problem….

Employee Rights: Returning to Work When Childcare is Limited

As Alberta continues to reopen, more employees are returning to work. It’s challenging, though, for parents who have children without…

Calgary employment lawyer & managing partner Charles Osuji awarded as one of Canada’s TOP 25 most influential lawyers

Calgary employment lawyer & managing partner Charles Osuji awarded as one of Canada’s TOP 25 most influential lawyers BY CANADIAN…

Good News for Employees in an Economic Downturn

Enough with the bad news already! We’re pleased to bring you some good news for employees in an economic downturn….

I Just Got Fired. Should I Sign a Severance Package Agreement and General Release?

You just found out you’ve been fired from your job. Most likely, you were given documents detailing the payments you’re…

Are You Entitled to Spousal Support?

When a married couple separates, one of the spouses may be entitled to spousal support. The amount and duration of…

Can you claim loss of income when you have been injured?

Often, people suffer injuries as a result of someone else’s negligent conducts. This is frequently the case in motor vehicle…

6 Important Facts About Child Apprehension in Alberta

The Child, Youth and Family Enhancement Act is the Alberta legislation governing the authority of Child and Youth Services to…

What am I Entitled to During the Termination Notice Period?

Getting fired from your job is one of life’s more stressful experiences. It can be an emotional time filled with…

MITIGATING WITH A HIGHER PAY JOB: WHAT A DISMISSED EMPLOYEE SHOULD KNOW

Before bringing a claim for severance or additional notice against your former employer, you must remember the corresponding “duty to…

6 Things You Need to Know About Mental Capacity And Your Future

Enduring Power of Attorney and Personal Directive Today, you have the freedom to decide where to live, how to invest…

What Does “Per Stirpes” Mean?

First things first. How do we pronounce per stirpes? Say it like “purr stir peas” or “pur stur-peez”. Now, what…

Job Protected Leave

Just as an employee can resign from a company by giving a notice, an employer may terminate an employee without…

Did I Just Quit? – When is a Resignation a True Resignation

Imagine it’s a busy night at the restaurant you work in and so far, you’ve been bustling just to keep…

How is Child Support Calculated in Alberta?

If you’re recently separated or divorced or struggling with child support issues, you’re probably wondering, “How is child support calculated…

COVID-19 Temporary Layoff Period Extension & What It Means for You

Businesses continue to reopen during the second phase of Alberta’s Relaunch Strategy, but employers and employees are still impacted by…

Is the Contract Unfair?

Duress – Focus is on the Consent of the Parties The key to duress is the over-bearing of a person’s…

DIRECTORS’ PERSONAL LIABILITY FOR EMPLOYEE WAGES

When you file a wrongful dismissal claim against your employer for severance, you expect to able to collect on your…

Toxic Work Environment – When It’s Time to Draw the Line

When it’s Time to Draw the Line – What Can Employees Do in a Toxic Work Environment? For many of…

How do I defend myself if my colleagues are lying?

If you’re searching for articles online on “how to deal with a lying coworker,” it’s probably safe to say that…

Parenting during COVID-19

Parenting during normal times could be a difficult task for parents. COVID-19 could definitely add to the challenges of parenting….

Damages for the Loss of Business Goodwill – How do we determine it?

In actions for breach of contract where the non-performance of a contractual obligation or anticompetitive behavior caused injury to the…

Consideration and Enforceability of Post-Contractual Obligations

Under common law, a contract requires offer, acceptance, and consideration. The element, “consideration” is a value that has been bargained…

How to Know if You are an Employee or Independent Contractor

Are you an employee or an independent contractor? Is your work arrangement an employee-employer relationship or a contractor-principal relationship? In…

Employment Termination & Wrongful Dismissal: What You Need to Know

Employment Termination and Wrongful Dismissal: What You Need to Know Getting fired is always stressful but especially when you’ve done…

Restrictive Covenants

Restrictive Covenants, also known as restraints against trade, are restrictions imposed on the way that the employee will do business…

Layoff and Constructive Dismissal

Calgary Constructive Dismissal | Layoff & Dismissal Lawyers COVID-19 has changed and continues to change, every Canadian’s life in one…

Working from Home: 8 Tips to Improve Productivity

Working from home has become a new trend due to the COVID-19 pandemic. Some of us really enjoy it, but…

6 Common Types of Workplace Discrimination: What to Know

Though many companies take workplace discrimination seriously, employees still face different sorts of discrimination in the workplace. It’s not very…

Living Trust: 7 Reasons Why You Need One

There is no doubt that trust is an essential part of estate planning. Many of your problems will be gone…

How to Manage Your Business and Employee Obligations During the Coronavirus (COVID-19)

The coronavirus (COVID-19) pandemic is going to last for a while. Many companies are facing hard times to manage…

HUMAN RIGHT ISSUES TO CONSIDER WHEN ENDING AN EMPLOYMENT RELATIONSHIP.

In every employment relationship, an employer has the duty to protect and accommodate the right to equal treatment of persons….

COVID-19 SAGA: WHAT EMPLOYERS SHOULD KNOW ABOUT STATUTORY NOTICE EXEMPTIONS & DOCTRINE OF FRAUSTRATION.

The COVID-19 pandemic brings a wave of economic uncertainty for businesses all over the world. From the largest corporations to…

Everything To Know About Immigrating To Canada During COVID-19 Outbreak

COVID-19, commonly known as Coronavirus, is affecting the world like nothing we have ever experienced. We are adapting and adjusting…

Coronavirus Pandemic: 8 Things Small Business Owners Need to Do

Coronavirus pandemic is a very risky time for small business owners. Here are some key points to protect your business in this disaster.

The CoronaVirus- Employee Rights and Employer Obligations

Like many places in the world, coronavirus is forcing employers and employees in Alberta to change their policies and strategies.

SOME EMPLOYMENT ISSUES ARISING FROM THE COVID-19 PANDEMIC.

We thank government for fighting hard to preserve Canadians’ incomes; however, there are other concerns arising from Covid-19 in the area of employment law.

6 Common Misconceptions About Wills and Probate

You might be surprised to know that many myths are running about wills and probate. Even you may believe some of these myths.

5 Benefits of Hiring an Immigration Lawyer

As Canada is welcoming immigrants all over the world, you need to speed up your game and hire the best immigration lawyer.

How to Sue Someone for Breach of Contract

Breach of contract could ruin your business and break your confidence. You may want to sue if you are facing a big loss. Read more!

10 Things You Need to Do After a Motor Vehicle Accident

You should watch your step after a motor vehicle accident. A wrong move can cost your benefit claims. Read more to know !

IS THE NON-COMPETITION CLAUSE ENFORCEABLE?

A non-competition clause is intended to protect the employer upon the breakdown of the employment relationship with an employee.

What do I need to know about uncontested divorce?

An uncontested divorce is the most amicable among all the divorces. Read more to know when and how you can go for this divorce.

WHAT IS CONSTRUCTIVE DISMISSAL?

If your employer has changed one of your employment conditions, you may be entitled to an award on the basis of constructive dismissal.

Foreign Child Adoption in Alberta: What You Should Know

Foreign child adoption is a complicated, time-consuming matter. Before planning the adoption, you need to prepare yourself right.

EMPLOYER’S DUTY OF GOOD FAITH IN THE MANNER OF DISMISSAL

Regardless of whether an employee has been terminated with cause or without cause, employers always have a duty to the employee being terminated.

8 Things You Shouldn’t Do as an Executor

If you are appointed as an executor of an estate, you need to watch your steps. There are some things you need to avoid when you are in this duty.

IS THE EMPLOYER’S SEVERANCE REASONABLE?

An employer must give an employee reasonable notice when terminating the employment of an employee in Alberta. To know details, read more!

Civil Litigation Lawyer: Top 7 Reasons to Hire

Even if you are dealing with a simpler case, you should hire a civil litigation lawyer. You wonder why is that? Read more to know!

6 Child Custody Negotiation Tips to Win Your Case

A child custody battle could be one of the most stressful events in divorce. Want to know how to make a better negotiation? Read more!

How To Prevent Cannabis Abuse In Workplaces

Cannabis abuse can impair the employees while they’re at work. So, what should you do to prevent cannabis abuse in your workplace?

Things To Do About Estate Planning After Divorce

You need to give some serious thought about estate planning after marriage. It will help you to deal better with legal issues in the future. Read more!

Canadian Super Visa: What Visitors Need To Know

Canadian Super Visa presents an excellent opportunity for you to spend quality time with your children or grandchildren living in Canada. Read more!

Power of Attorney: Why You Should Need One

A power of attorney is as crucial as trusts and wills. If you want to do estate planning, you need to give a considerable thought about it. Read more!

The Effect of Workplace Bullying

More employees are facing workplace bullying than you think. It detorietes employee’s mental health as well as productivity. Read more!

5 essential questions to ask a real estate attorney

Real estate attorney makes your real estate deals smooth and tension free. If you want to hire the best attorney, better ask him/her some real questions.

Top Ten Personal Injury Lawsuit Tips

You may think only hiring a lawyer is enough for personal injury lawsuit. Well, there are many things you can do your own too. Read more!

Why Do You Need to Hire a Probate Lawyer

As far as estate administration and estate planning concerns, probate lawyer is immensely important. Want to know more? Well, read more!

Everything You Need to Know About Divorce in Alberta

Divorce is a complicated issue. It needs proper steps and precautions. Want to know about divorce in Alberta, read more !

An overview of the types of trust in Canada

Trust is an integral part of estate planning. It is crucial for you, your family, and your future generations. Read more!

Why hire a business lawyer for your small business?